Social security and medicare tax calculator self employed

All your Self-employment news in one place. Which Medicare Plan Is Right For You.

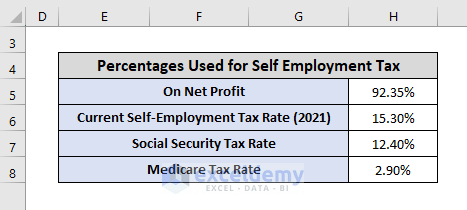

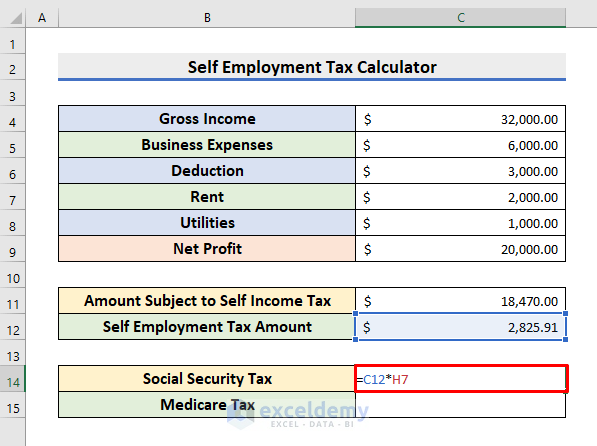

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

When you are self-employed then.

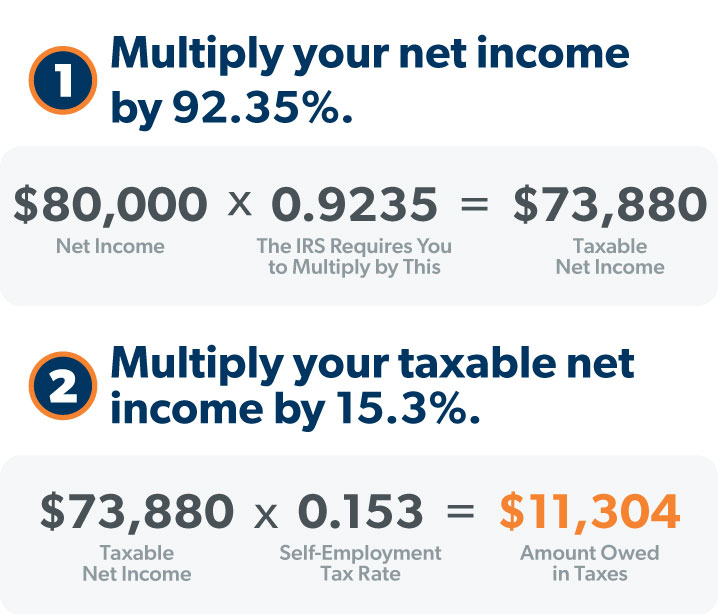

. In 2022 all your earnings are subject to a 29 tax representing the 145 Medicare tax that comes out of employee paychecks plus the 145 employer. How much is Social Security tax for the self-employed. For taxable year 2021 153 percent of the amount subject to self-employment income tax must be paid as self-employment tax.

The Social Security tax rate for self-employed is 153 percent. Try Our Free Tax Refund Calculator Today. How much self-employment tax will I pay.

The rate is made up of both of these. Get the latest Self-employment news and enjoy our posts videos and analysis on Marca. For 2021 the maximum amount subject to.

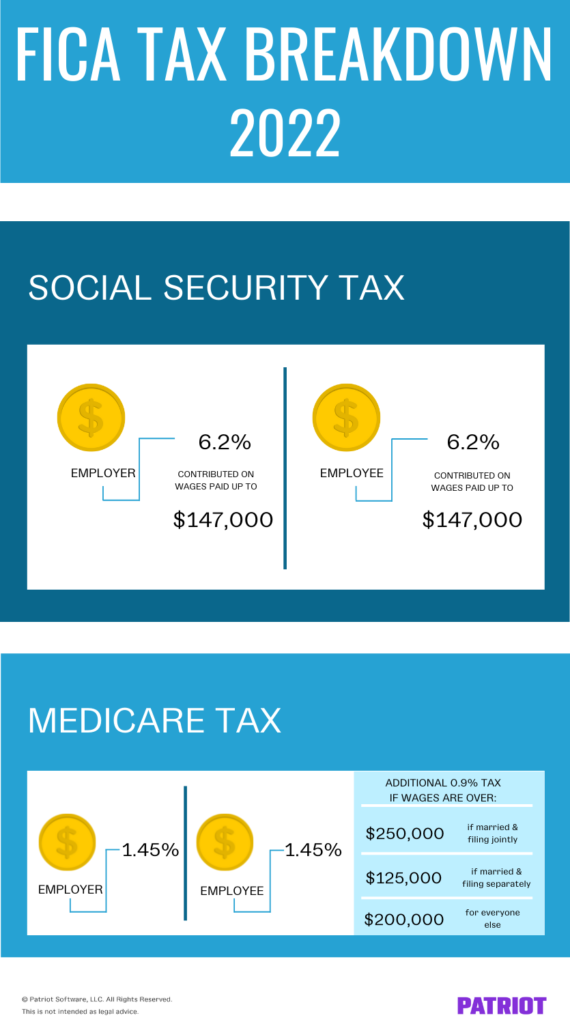

Self-employed individuals pay both the employer and employee share of the Social Security payroll tax. Social Security tax for the self-employed is 124 of net earnings on up to 142800 of income 14700 in 2022. Normally these taxes are withheld by your employer.

Employees who receive a W-2 only pay half of the total. This is composed of two parts. Up to 10 cash back Self-employment tax consists of Social Security and Medicare taxes for individuals who work for themselves.

It is similar to FICA which is the Social Security and. You Could Still Apply for 2022 Coverage. For 2022 the self-employment tax rate is 153 on the first 147000 of.

See All Plans And Compare Benefits And Costs. If you are a high earner a 09. Discover Helpful Information And Resources On Taxes From AARP.

Utilize this self-employed tax calculator to assess your self-employment expenses. Use this calculator to estimate your self-employment taxes. The self-employment tax applies to your adjusted gross income.

Ad Missed Annual Enrollment Period. Tax Preparation For Small Business When you work for business your profit burdened at a 62. Helping You Avoid Confusion This Tax Season.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Medicare tax 8000 29 23200 So total FICA tax social security and Medicare tax a person employer and employee or self-employed s has to. Self-employment tax consists of 124 going to Social Security and 29 going to Medicare.

The Social Security portion has a limit on how much of your income is taxed currently 142800 or. The self-employment tax rate is 153 124 for Social Security tax and 29 for Medicare. The 124 percent that goes to old-age survivors and disability insurance and the 29.

Self employment taxes are comprised of two parts. You will pay 62 percent and your employer will pay Social. Self-employed workers get stuck paying the entire FICA tax on their own.

Social Security and Medicare. 2 days agoBased on Social Security earnings test 1 of your benefits would need to be withheld for each 2 that you earn in excess of 19560 this year. Self-employment tax SE tax is the Social Security and Medicare tax paid by self-employed individuals.

124 Social Security tax. For 2021 the self-employment tax rate is normally 153. That would almost certainly.

However if you are self-employed operate a farm or are a church employee. To calculate your FICA tax burden you can multiply your gross pay by 765. Ad No Matter What Your Tax Situation Is TurboTax Has You Covered.

This is the sum of the social security and.

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Easiest 2021 Fica Tax Calculator

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

What Is Fica Tax Contribution Rates Examples

![]()

Self Employment Tax Calculator Estimate Your 1099 Taxes Jackson Hewitt

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

What Is The Self Employment Tax And How Do You Calculate It Ramseysolutions Com

Self Employment Tax Calculator To Calculate Medicare And Ss Taxes

/self-employed-contributions-act-seca-tax-5198333_final-e6dcd593b641422493714b7275b9df73.gif)

What Is The Self Employed Contributions Act Seca Tax

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Self Employment Tax Calculator For 2021 Good Money Sense Income Tax Preparation Self Employment Business Tax

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Self Employment Tax Calculator For 2020 Good Money Sense Business Tax Deductions Money Management Printables Money Management

Self Employed Tax Calculator Business Tax Self Employment Self

Free Self Employment Tax Calculator Shared Economy Tax

/self-employed-contributions-act-seca-tax-5198333_final-e6dcd593b641422493714b7275b9df73.gif)

What Is The Self Employed Contributions Act Seca Tax