30+ paying mortgage twice a month

Web Since youre making two extra payments per year with a biweekly plan youll pay your loan off much quicker than with a bimonthly plan. Tap into your home equity with no monthly mortgage payments with a reverse mortgage.

3 Biweekly Mortgage Templates In Pdf

Zeibert gives the example of a 30-year fixed loan of 250000 at a 4 interest.

. Your monthly payment would come to 1081. Web The payment option commonly called bi-monthly is a bi-weekly payment option. Ad Dedicated to helping retirees maintain their financial well-being.

Web Following the above example that would mean paying 800 twice in one chosen month annually. Web To make things concrete consider a hypothetical homeowner Lena with a 30-year 30 fixed-rate mortgage of 500000. Compare Now Save.

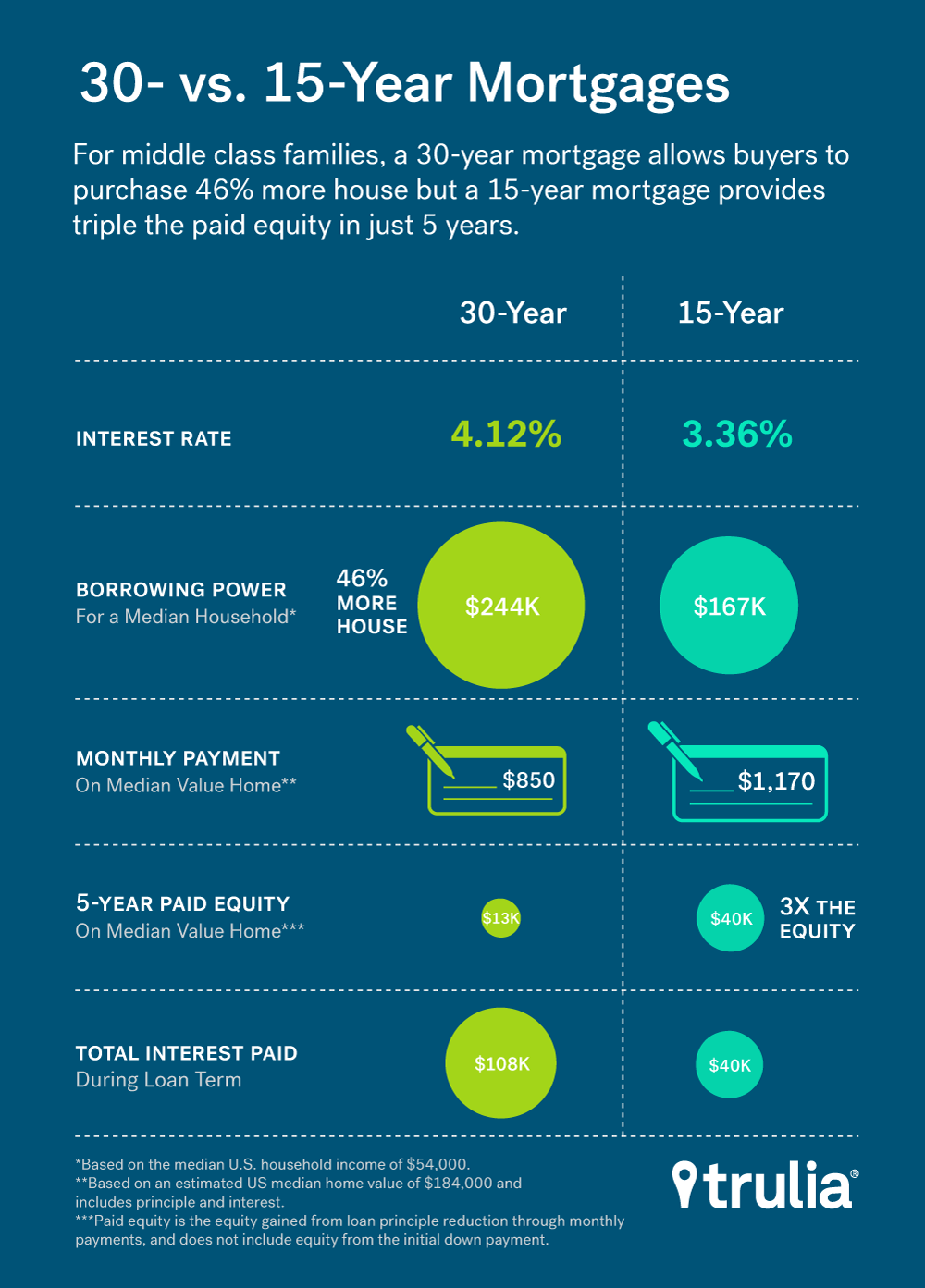

The general rule is that if you double your required payment you will pay your 30-year fixed. Splits your monthly payment into two half payments. Web Tens of thousands of dollars can be saved by making bi-weekly mortgage payments and enables the homeowner to pay off the mortgage almost eight years early.

Pay your loan down faster. Get Instantly Matched with Your Ideal 30 Year Mortgage Lender. There is an alternative to monthly payments making half your monthly payment every two weeks.

Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. When you make biweekly payments you. Web How much faster do you pay off a mortgage with double payments.

See if you qualify. Web A biweekly mortgage payment plan involves making half of that mortgage payment or 104750 every two weeks for a total of 26 payments each year. If you double the payment the loan is paid off in 109 months or.

Web Lets say you have a 30-year fixed-rate mortgage for 250000 with a 32 percent interest rate. Web For example if you have a 30-year loan with 1450 monthly mortgage payments youll pay 17400 per year toward your mortgage. Web Biweekly mortgage payments.

2022s Top Mortgage Lenders. If you have a 200000 mortgage at 3 for 30. Web What happens if I pay an extra 200 a month on my 30 year mortgage.

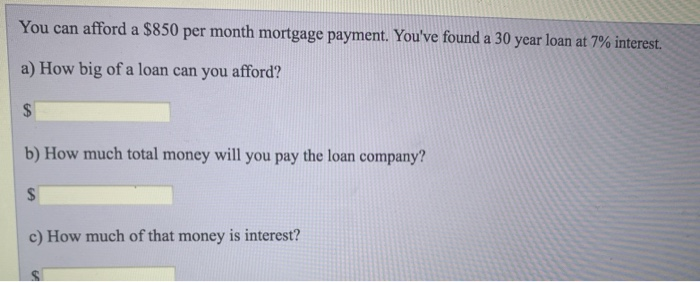

Web Granted if youre planning to stay in your home for 30 years you may not give two shakes about paying extra and feel comfortable anticipating the same. Web A 100000 mortgage with a 6 percent interest rate requires a payment of 59955 for 30 years. Ad 30 Year Mortgage Rates Compared.

If you make the payment at the beginning of each year youll. Select Apply In Minutes. Choose The Loan That Suits You.

But if you switch to a. If you pay 200 extra a month towards principal you can cut your loan term by more than 8 years and. For example a 250000 30.

It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Web Every two weeks. Web If you have a 300000 mortgage at 4 for 30 years biweekly payments will save you 35000 in interest payments.

However some lenders offer a bi-monthly payment service to homebuyers. Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property. Web Youll need to weigh all the factors before deciding whether to commit to biweekly mortgage payments.

How Much Interest Can You Save By Increasing Your Mortgage Payment. Ad Get All The Info You Need To Choose a Mortgage Loan. Lets consider the pros and cons of entering a biweekly.

Web When you buy a home with a mortgage your payments are due monthly by default. Her monthly mortgage payment is. There are usually two months per year where youll make an additional half.

Mortgage Overpayment Calculator Pay Off Your Debt Early

Biweekly Vs Monthly Mortgage Payments What To Know Chase

Mortgage Estimates Are 50 Higher On Redfin Vs Zillow What Are The Differences In Their Respective Basic Assumptions Quora

What Are Biweekly Mortgage Payments And Are They A Good Idea Ramsey

3 Biweekly Mortgage Templates In Pdf

![]()

Should You Make Biweekly Mortgage Payments Nerdwallet

Biweekly Mortgage Calculator

Solved You Can Afford A 850 Per Month Mortgage Payment Chegg Com

Bi Weekly Mortgage Payment Savings Biweekly Mortgage Amortization Program

Where 15 Can Beat 30 Trulia Research

Does Paying Your Mortgage Twice A Month Save You Money

:max_bytes(150000):strip_icc()/100715384-5bfc2e0546e0fb0051be4eb7.jpg)

Is Making Biweekly Mortgage Payments A Good Idea

How To Create A Biweekly Budget In 5 Simple Steps Clever Girl Finance

/cloudfront-us-east-1.images.arcpublishing.com/dmn/5Z6SY3NW7ZFVJA6HR4U4RYSHPU.jpg)

Mortgage Rates Rise Above 7 For First Time In Two Decades

Mortgage Deferrers Are Weaker Borrowers But How Much Weaker Ratespy Com

Some Mathematics Of Investing In Rental Property Floyd Comap

Understanding The Details Of Your Mortgage Payment Homewise